in its short 10-year history,

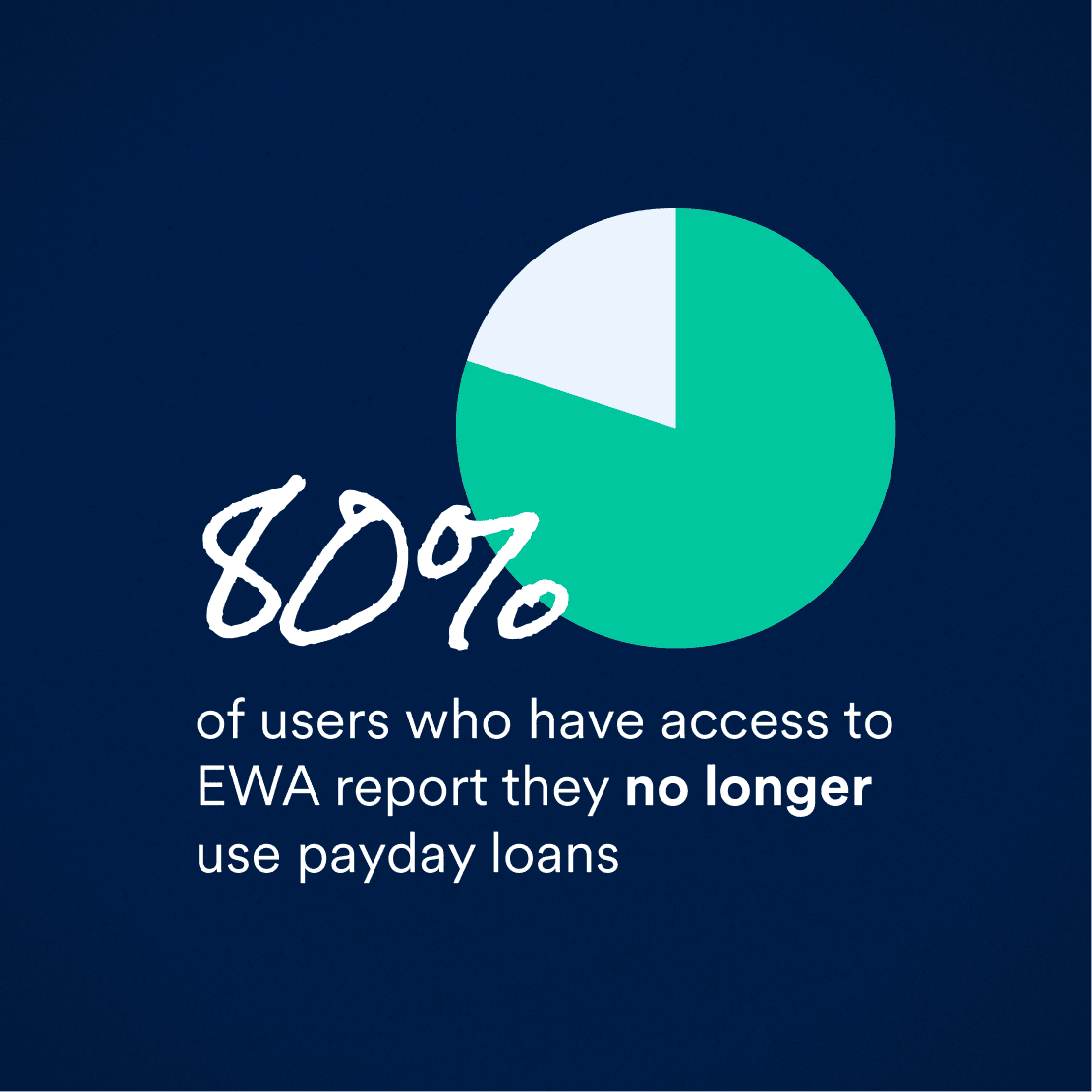

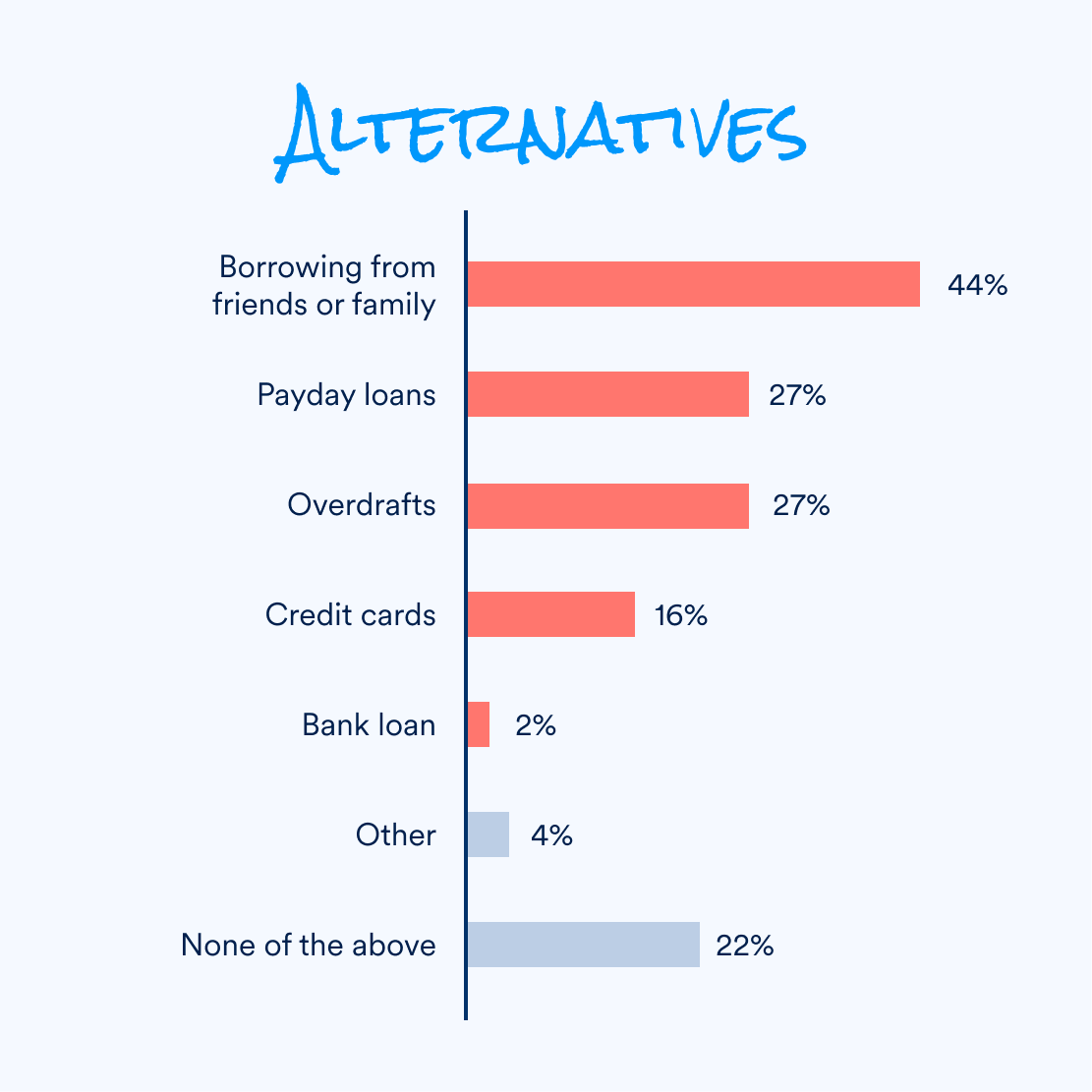

EWA has had a tremendous impact by increasing the financial resilience of workers, providing employers with valuable recruitment and retention tools, and ushering in new expectations on the timing of pay and the rights of workers.

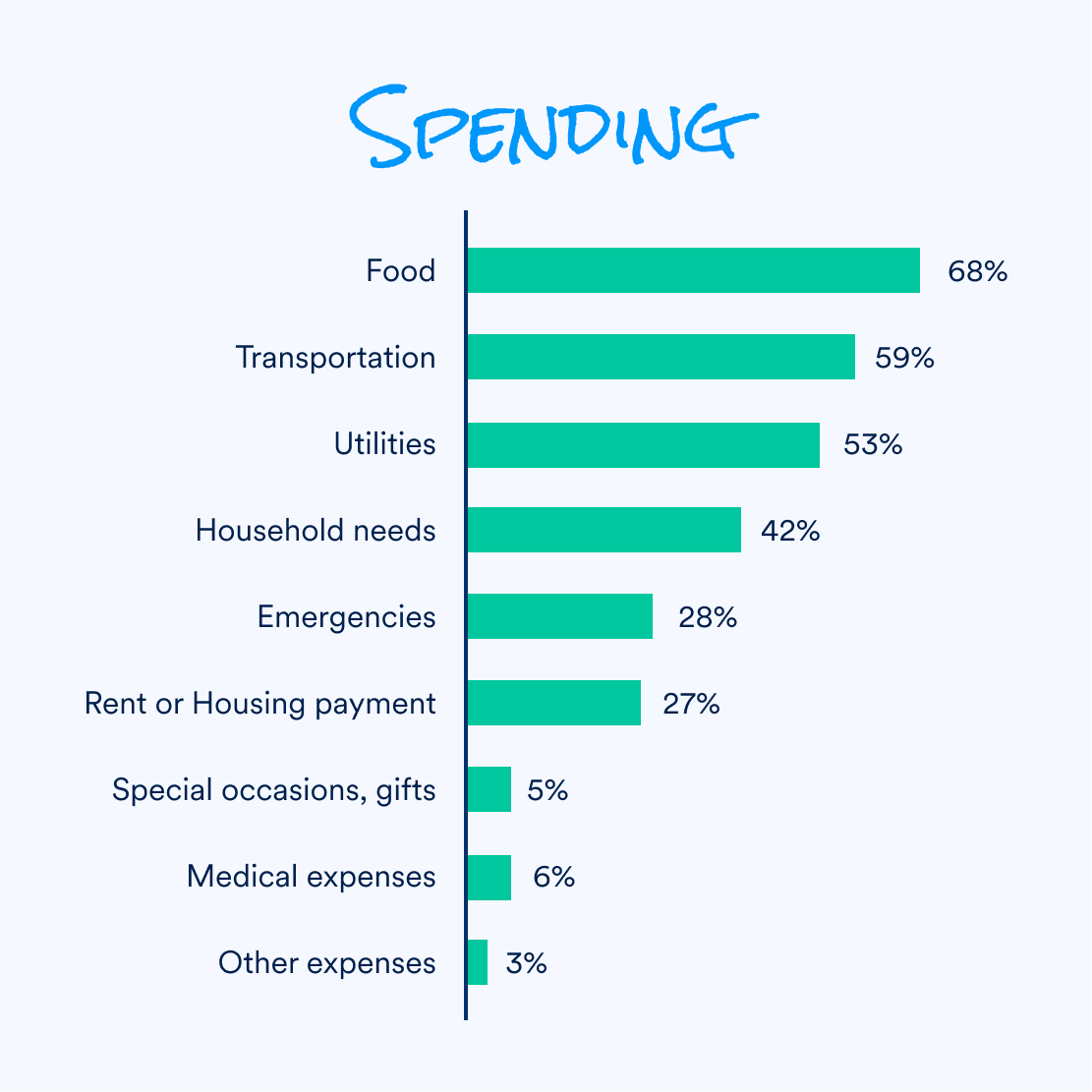

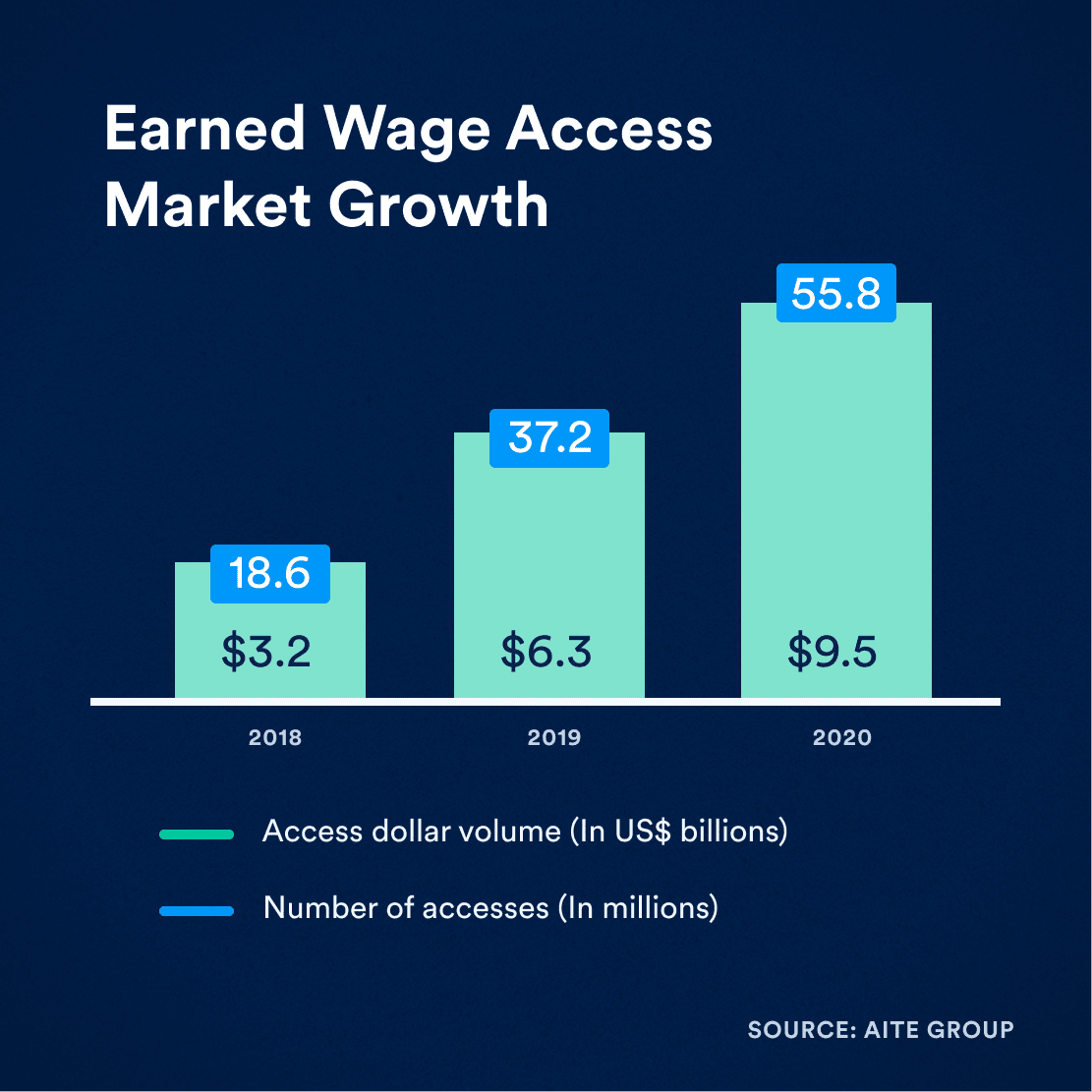

Today, EWA has solidified as a table stakes employee benefit and critical financial security tool for workers. It is estimated that there were 55.8 million EWA uses totalling $9.5 billion in 2020. Access to already earned wages is a critical lifeline for workers in times of emergencies, and also to pay for their livelihood needs like food, transportation, and rent.